Graphite has swung into focus in recent years, largely due to its key role in electric vehicle (EV) batteries.

Concerns about China’s supply stranglehold and anticipated demand from lithium-ion battery megafactories have sparked investor interest, and experts believe graphite will be a key EV battery material for at least the next decade.

To help investors get a better understanding of the graphite space, here’s a brief overview of what graphite is, what’s going on in the market today and what the future could bring. Read on for insight on these topics and more.

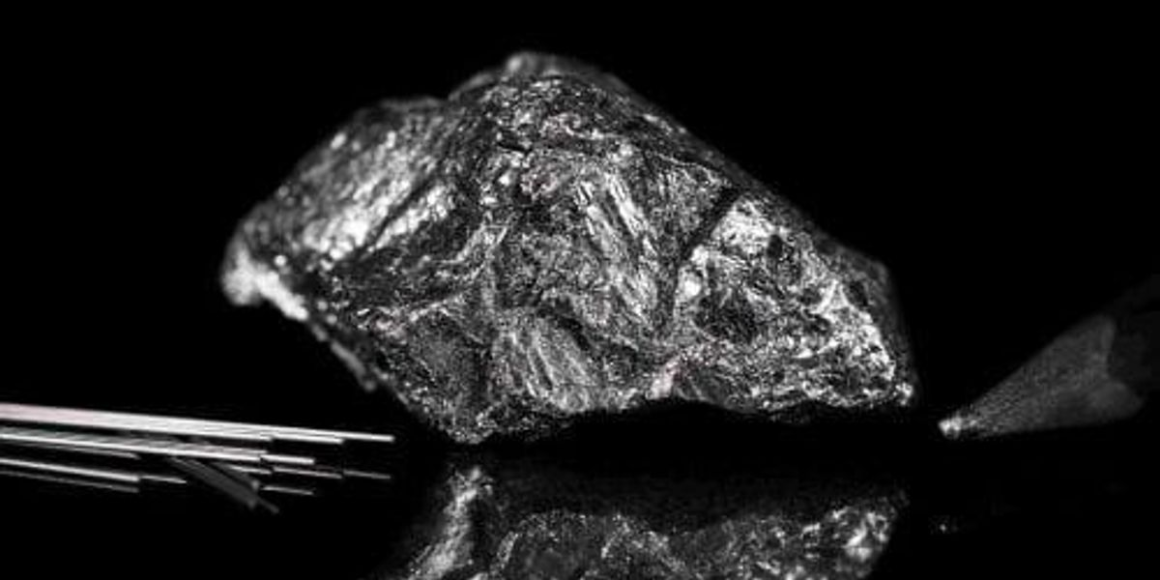

Graphite has a layered, planar structure, with carbon atoms arranged in a honeycomb lattice. It’s thermally stable and can conduct electricity, but is also valued for its self-lubricating and dry-lubricating properties.

Flake, amorphous and vein are the three main types of graphite; all are important for different industries, but flake graphite is currently getting the most buzz.

Aside from batteries, flake graphite can be used in pebble-bed nuclear reactors, as well as in the refractory and steel industries, fuel cells and vanadium-redox batteries. Amorphous graphite is used in the refractory industry as well, and in mechanisms such as brake linings, gaskets and clutch materials. Vein graphite finds a home in advanced, thermal and high-friction applications.

As mentioned, flake graphite has seen attention as graphite market participants try to guess how much impact facilities like Tesla’s gigafactory — and other lithium-ion battery megafactories — will have on graphite demand.

For now, much of that demand has yet to materialize. Many companies that rushed into the graphite space have not yet secured offtake agreements for the material they plan to produce. As a result, some are stalled in the exploration and development phases; it will be difficult for them to move forward until end users start locking down supply.

“We expect to see premium pricing structures emerge in ex-China markets to reflect higher costs associated with ESG friendly supply, but also to encourage the much-needed investment in the sector to prompt the development of localized and diversified supply,” the firm’s analysts said in a report published in mid-2023. “Without additional investment, the market will fall into a significant deficit beyond 2030.”

The upshot is that graphite demand appears set to rise with no guarantees that producers will be able to keep up. Prices remain subdued, but may rise as buyers become more concerned about impending megafactory demand.

Speaking of prices, how much does graphite cost? Unfortunately, it can be difficult to get exact figures. Unlike gold, silver and other commodities, graphite is not traded on an exchange. Instead, graphite miners will typically set up offtake agreements under which end users agree to buy a specific amount of graphite over a particular period of time.

That setup comes with a variety of issues for graphite companies and market participants, but for many investors the key concern is that they can feel like they’re operating blind. After all, it’s hard to get an idea of whether a company is putting out good results without having an idea of how much it will be able to sell its product for.

While the graphite market is compelling, it can be tricky for investors to gain a toehold in the space.

As noted, graphite is not traded on an exchange, meaning that investors can’t get exposure to the physical material. What’s more, it isn’t easy to invest in graphite-mining companies — most of the largest graphite producers are in China, and in many cases are privately owned or only listed on Asian exchanges.

This is an updated version of an article originally published by the Investing News Network in 2015.

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Leave a Reply