Tin prices have been supported in recent years by surging electronics demand amid a deficit in supply.

In addition, signs of rebounding Chinese demand and the need for tin’s soldering properties in infrastructure and artificial intelligence (AI) chip are prompting bullish sentiment for the metal.

Because of its strong fundamentals, interest in tin investing is increasing. To help investors looking to jump into this commodity sector, the Investing News Network has put together a brief guide on tin supply and demand dynamics, as well as an overview of how to start investing in this silvery white metal.

The tin market has been in deficit for the past decade, and supply is expected to remain constrained as demand rises.

Tin’s positive characteristics mean it has a slew of important uses. For example, the metal is malleable, ductile and not easily oxidized in air; it’s also lightweight, durable and fairly resistant to corrosion.

Those qualities make tin, which is obtained from the mineral cassiterite, a good candidate for use in solder, as well as tinplate, chemicals, brass and bronze and other niche areas.

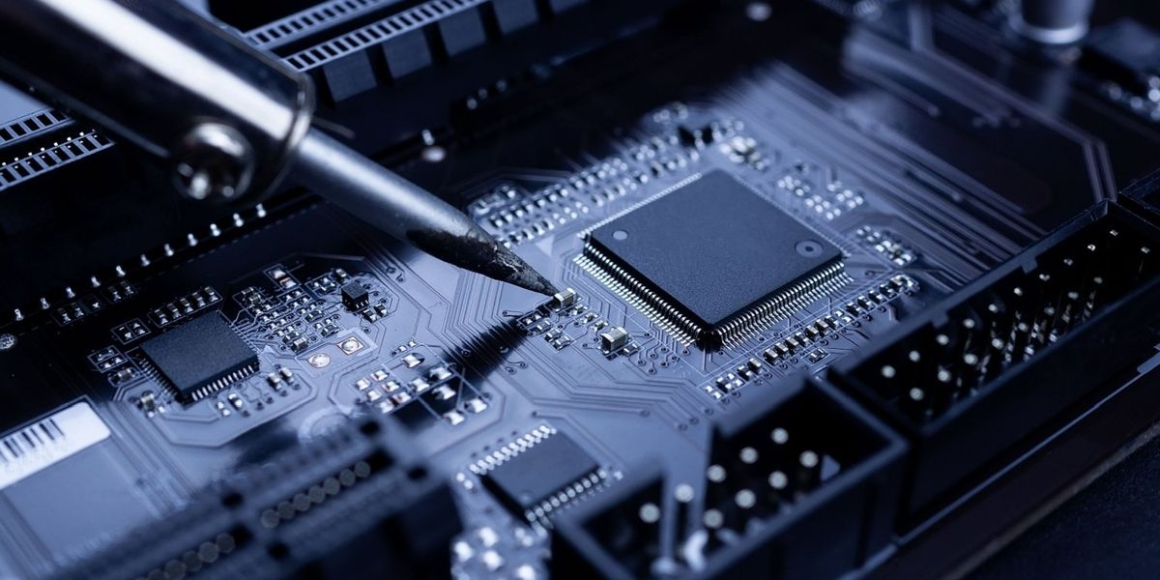

Today the electronics industry is the sector to watch for investors who are keeping an eye on tin. The metal is used in semiconductor circuit-board soldering, an application that accounts for about half of global tin consumption. As electronics become more advanced, they require more semiconductor chips, and hence, more tin. AI chips are especially complex and represent an emerging source of increased demand for the metal.

Myanmar is behind China at 54,000 MT, and third on the list is Indonesia at 52,000 MT. Peru and the Democratic Republic of Congo (DRC) are next with 23,000 MT and 19,000 MT, respectively. Total world output for the year was 290,000 MT, down by 17,000 MT from the previous year, and world tin reserves sit at 4.3 million MT.

Paying attention to tin inventory changes on the London Metal Exchange (LME) is also a good strategy for gaining insight on tin market developments. As the bullish story for tin develops, speculative buying has increased on the LME. The result is that headline tin stock levels on the exchange dropped by 46 percent between the beginning of 2024 and mid-April, coinciding with the two year price high for the metal.

As mentioned, investing in tin is becoming more and more appealing as demand for the metal grows.

Those wishing to begin tin investing may want to consider tin futures, which are traded on the LME under the code SN, with contract pricing in US dollars per MT. Clearable currencies include the US dollar, yen, pound and euro.

This is an updated version of an article first published by the Investing News Network in 2019.

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Leave a Reply