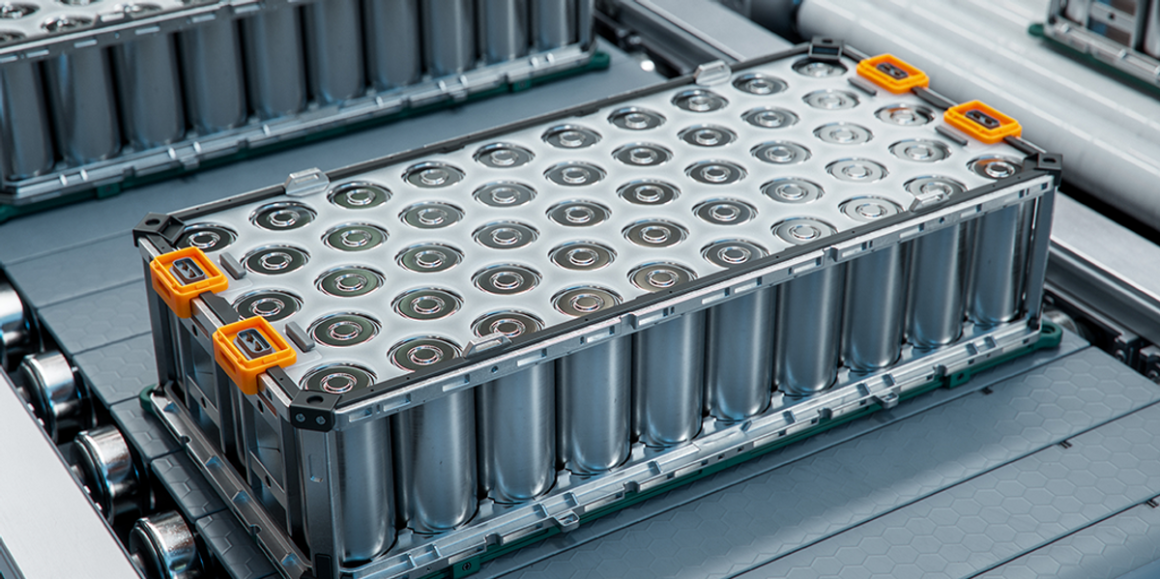

You can’t make lithium-ion batteries, a critical component of electric vehicles (EVs) and other devices of the new green economy, without lithium. But securing a stable, secure and politically neutral supply chain for so-called white gold is a challenge.

Hard-rock lithium conversion entails converting mined lithium spodumene ore into lithium sulfate, then battery-grade lithium carbonate or lithium hydroxide.

Having access to facilities undertaking this process is just as important as having access to lithium mines. Many countries understand this and endeavour to improve their lithium supply chains. The goal is to establish facilities where geopolitical wrangling is not a concern, that are closer to home and take environmental values into account — hard-rock lithium conversion can be environmentally intense, especially in jurisdictions with looser environmental controls. Concerns range from water use to consumption of electricity in jurisdictions where fossil fuels power the electricity grid.

It’s already taken a firm hold of the raw resource market by investing heavily in the so-called Lithium Triangle made up of Argentina, Chile and Bolivia, plus it’s made forays into Afghanistan. China uses off-take contracts, which guarantees a mine or processor a certain amount of product purchased at an agreed price, which helps fund its operations and cements a long-term relationship.

There are a number of concerns regarding China’s de facto monopoly on hard-rock lithium conversion. There are risks it could exert too much control over its partners, even lead to possibly bullying over prices and market access. It would dominate any negotiations around international policies related to lithium supply chains.

Meanwhile, other players in the market do not have much in the way of bargaining power in this uneven market, making it increasingly difficult for newcomers to gain a foothold — a situation that could worsen if China’s dominance were to grow further, causing a snowball effect.

Concerns about the international lithium-processing market are well known, and many nations are making federal-level efforts to encourage a more diverse industry and to secure their own supply chains.

Led by lithium mining pioneer Iggy Tan, the company has assembled a ‘dream team’ that is moving the company toward its goal of becoming a key player in the critical minerals and battery supply chain, a statement from Lithium Universe’s website says. The Bécancour Lithium Carbonate Refinery is part of Lithium Universe’s Québec lithium processing hub strategy, which also includes a stand-alone spodumene concentrator.

Lithium conversion facilities are becoming an attractive investment opportunity across the globe as nations vie to secure supply chains by offering incentives for projects and investors. With lithium-ion batteries a key component for a myriad of green products, this once underdeveloped industry — at least outside of China — is set to transform.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

Leave a Reply