Under the agreement, AEFI has the option to acquire the project as part of a proposed US listing by paying AU$450,000; it will also make certain payments, and will solely fund AU$2 million worth of exploration.

Other conditions include an option fee of AU$50,000, AU$25,000 of which has already been paid by AEFI.

Trek said its subsidiaries Edge Minerals and Bellpiper hold the tenements that make up Hendeka, which is located in Western Australia’s Pilbara region; AEFI will acquire these subsidiaries if it chooses to exercise its option.

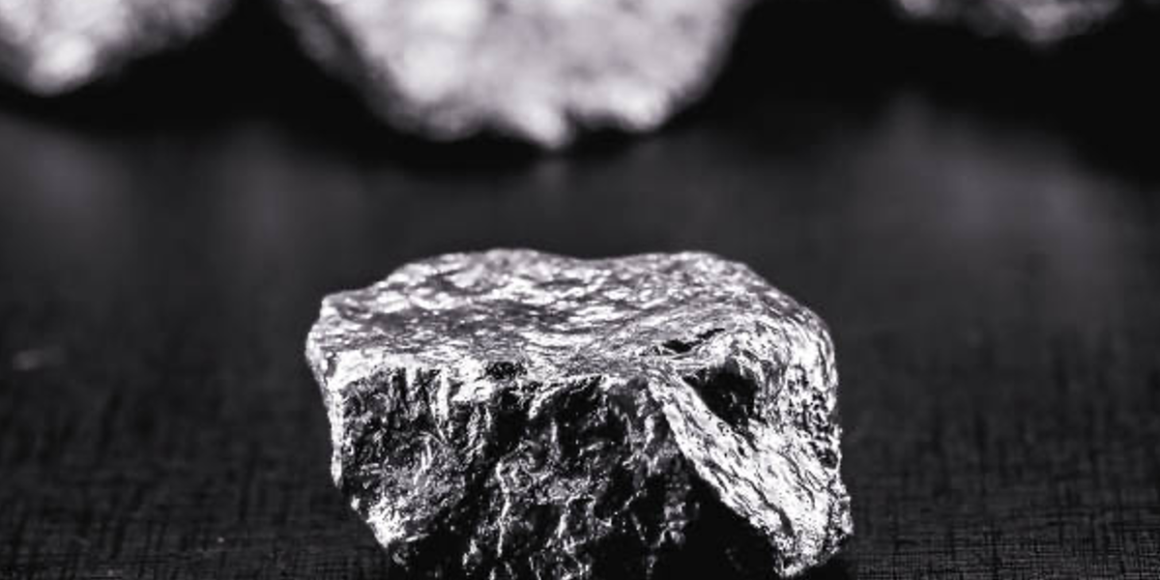

The company acquired Hendeka in November 2022. A JORC-compliant inferred resource estimate outlines 11.3 million tonnes grading 15 percent manganese for the Contact and Contact North deposits.

AEFI can exercise its option any time until September 30, 2027, and will spend the AU$2 million on exploration at Hendeka leading up to that time, including minimum expenditures to maintain the tenements in good standing.

“The Hendeka Project offers significant optionality on the resurgence of the manganese sector following recent well-publicised global supply issues,” said Trek CEO Derek Marshall. “The deal is structured in a way that will give Trek significant exposure to future upside from the exploration and development of Hendeka via a 20 percent shareholding.”

He also explained that Hendeka has become a non-core project for the company given a major gold drilling program that is in the works at its Christmas Creek project, and momentum surrounding its McEwen Hills niobium project.

Trek and AEFI have also signed a separate investor rights agreement giving Trek the right “but not the obligation to appoint one Director to AEFI, as well as customary participation and information rights in AEFI.”

AEFI’s listing is expected to occur on or before September 30, 2025.

Securities Disclosure: I, Gabrielle de la Cruz, hold no direct investment interest in any company mentioned in this article.

Leave a Reply